If you live in Massachusetts, then you should know that you can take advantage of many tax incentives to install solar power. Section 1603 grants are available to installations that were made prior to December 31, 2011. You can make money selling the solar energy produced by this program, also known as SREC. The system can be paid off within five to six months and you will still earn income over the lifetime of it.

Tax credits

Massachusetts residents can get tax credits to help make their solar investment more affordable. The Solar Massachusetts Renewable Target (SMART), a state program that provides incentives to homeowners who install solar panels in their homes, is offered by the government. This program offers monthly payments to customers who install solar panels in their homes. The program is sponsored, among others by Eversource and Massachusetts Department of Energy Resources. The goal of the program is to generate at least 3,200 megawatts of solar energy in the state. To be eligible for the program, you will need to connect your system to one or more of the three state investor-owned utilities. Each utility has different requirements for qualifying projects and the amount of rebates can vary widely.

Massachusetts also offers Solar Power Performance payments, also known as production incentives. These payments are small cash sums that are based on your actual renewable energy system's performance. This is more efficient than paying for the system's rated power. As a result, you can get credit for the electricity you produce, which will help your solar PV system pay for itself.

Exemptions for property taxes

Massachusetts property tax exemptions can be a great way homeowners to save money and reduce their tax bills. To be eligible, your home must have been owned for at least one-year. Some cities and towns also offer exemptions, but not every homeowner can qualify for them. There are different requirements to be exempted depending on where you live and the time period of your tax collection.

If you possess taxable personal assets, you must file the Form of List with your local board of appraisers. This form must be filed no later than March 1, prior to the start of the fiscal year. If you have your own furniture and effects, or if the charity you work for requires you to file a Form of List.

A tax exemption may be available for your personal and real assets if you are a Massachusetts National Guard or Reserve member. Hingham (MA) recently approved a program for reducing taxes for veterans, military personnel, and their families. For more information, contact your local assessor. If you are a Veteran, you might be eligible to get a reduced tax of up $1,500 for real or personal property.

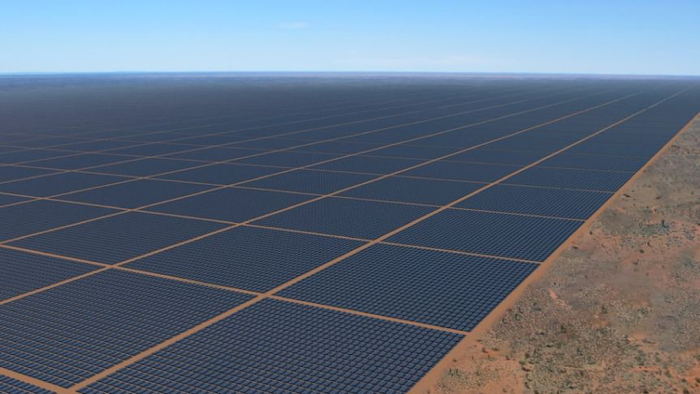

State solar incentive program

The Massachusetts state-sponsored solar incentive program (SMART), recently was expanded to include additional customers in low-income communities. This program offers incentives based upon the amount of solar panel generation per kWh. Customers can expect rebates of 20-35% depending on their utility's solar production.

This program encourages Massachusetts' addition of 1.6GW of solar power. The state has established eight 200-MW sequential Tarife Schedules. They are distributed on a first came, first served basis. The reimbursement for solar energy systems is determined by when you sign the contract. Massachusetts's average SMART payment for solar energy systems is $950 annually.

The SMART Program is a complex program of incentives designed to guide solar projects towards energy equity and distributed generation. This program provides a spreadsheet tool that allows you to calculate incentives. A net metering policy is required for solar projects. Massachusetts law allows solar projects to generate less than 60kW. If the utility receives this amount, it will pay the homeowner a discount on their retail energy rates.